Robert Kiyosaki’s Warning: Stocks, Bonds, and Real Estate Are Set to Collapse

Robert Kiyosaki warns of a financial market collapse, “Invest in real assets”

Robert Kiyosaki, best known as the author of the bestseller Rich Dad Poor Dad, has pointed out the debt risk in the United States. He has sparked a debate by mentioning the possibility of a market collapse and arguing that attention should be paid to gold, silver, and Bitcoin.

It has been revealed that the CEO of blockchain startup Ripple predicts that the cryptocurrency market will double by the end of this year, surpassing $595 billion.

In the current situation, cautious views are being raised about the U.S.’s interest rate cut in June. Gold prices are breaking records daily, and Bitcoin is also fluctuating after surpassing $85,000, but it appears to maintain an upward trend, drawing attention to these prospects.

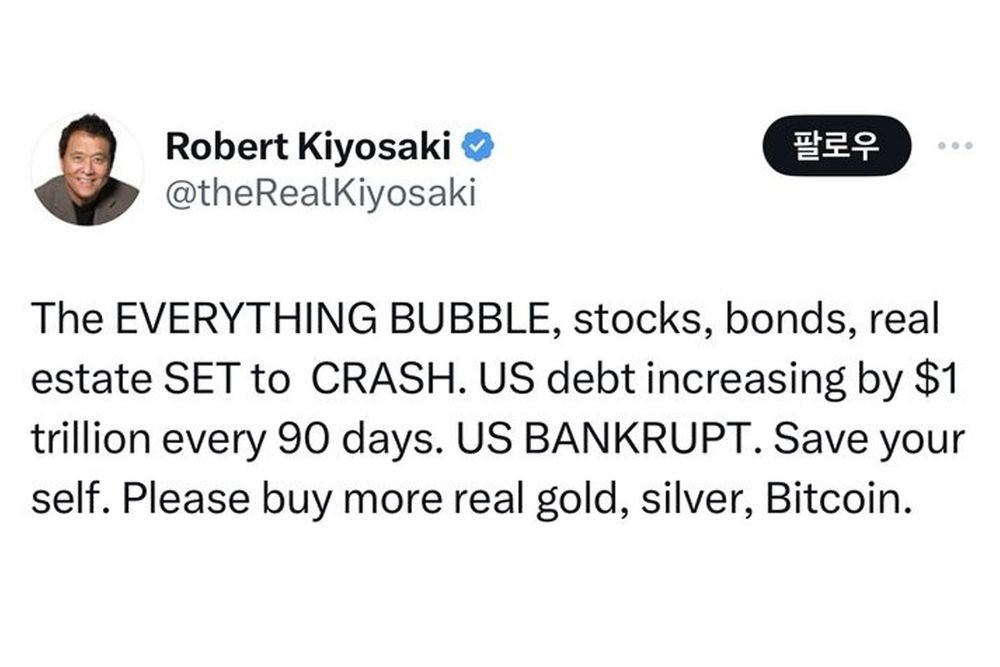

On the 7th, Robert Kiyosaki posted on his X (formerly Twitter), “All assets, including stocks, bonds, and real estate, that are inflated will collapse,” warning of a financial market collapse. He then pointed out that the U.S. federal government’s debt is increasing by about $1 trillion every 90 days, saying, “The United States is essentially bankrupt.”

Robert Kiyosaki did not stop at the warning, advising that investors need to pay attention to gold, silver, and Bitcoin to survive a market collapse. He stated that investors should not depend on fake currencies like the dollar to protect their assets and that gold, silver, and Bitcoin, which have real value, will be the ones to protect their wealth.

While most industry experts agreed with Robert Kiyosaki’s warning, there were also opposing views. Nick Maggiulli, the author of Just Keep Buying, posted, “Is this crash only 70%?” pointing out that since 2011, Kiyosaki has been warning of an impending economic crisis. He refuted Kiyosaki’s claim, stating that the U.S. stock index has consistently risen contrary to the economic crisis Kiyosaki claims.

In support of Kiyosaki’s claim, the CEO of blockchain startup Ripple optimistically forecasted that the cryptocurrency market would double by the end of this year, surpassing approximately $5.95 trillion.

On the 7th local time, Brad Garlinghouse, CEO of Ripple, which is also the issuer of Ripple (XRP), currently ranked 7th in total market capitalization of cryptocurrencies, made this prediction on CNBC in the U.S., mentioning the launch of a Bitcoin spot exchange-traded fund (ETF) early this year and the Bitcoin halving at the end of this month.

CEO Brad Garlinghouse stated, “I’ve been in the industry for a long time, and I see these trends come and go,” adding, “I think macro trends, factors like ETFs, are for the first time drawing institutional money.”

He also said, “We see this stimulating demand while at the same time, we see demand increasing and supply decreasing,” suggesting that even those who did not major in economics can understand what happens when supply and demand expand.

CNBC reported that as of the 4th, the total market size of cryptocurrencies is about $2.6 trillion, and if the market doubles, it will be $5.2 trillion. This increases from about $2.92 trillion to about $5.84 trillion.

Bitcoin is currently confirmed to account for about 49% of the entire cryptocurrency market. As of the 1st, its market capitalization is $1.3 trillion, which is approximately $1.46 trillion in Korean won.

Bitcoin has surged over 140% in the past 12 months and is trading at $71,214 as of 11 a.m. Korean time on the 9th.

CEO Garlinghouse expressed hope that the administration will focus more on accommodating the cryptocurrency industry due to the election in the United States this year.

He then stated, “The United States is still the largest economy in the world, but unfortunately one of the most hostile cryptocurrency markets,” and predicted that “the United States will start to change,” foreseeing a flexible change in the U.S. cryptocurrency market.

Meanwhile, Robert Kiyosaki caused a stir by posting on X before predicting the financial market’s collapse and that the Chinese stock market was desperate.

On the 21st of last month, Kiyosaki posted on his X, “The Chinese authorities are borrowing money to buy stocks to save the stock market; they seem to be in serious trouble,” and “This is a foolish and desperate situation.”

He emphasized the situation where investors worldwide stopped buying Chinese stocks and argued that it was not the time to buy stocks and bonds. He is known to have advised, just like the post he posted on X this time, that “if you are a wise investor, it is a good way to buy real gold, real silver, or as much Bitcoin as possible.”

Most Commented