China establishes $35 trillion semiconductor fund

Chinese funds decline amid economic downturn

Urgent need to address real estate issues in China

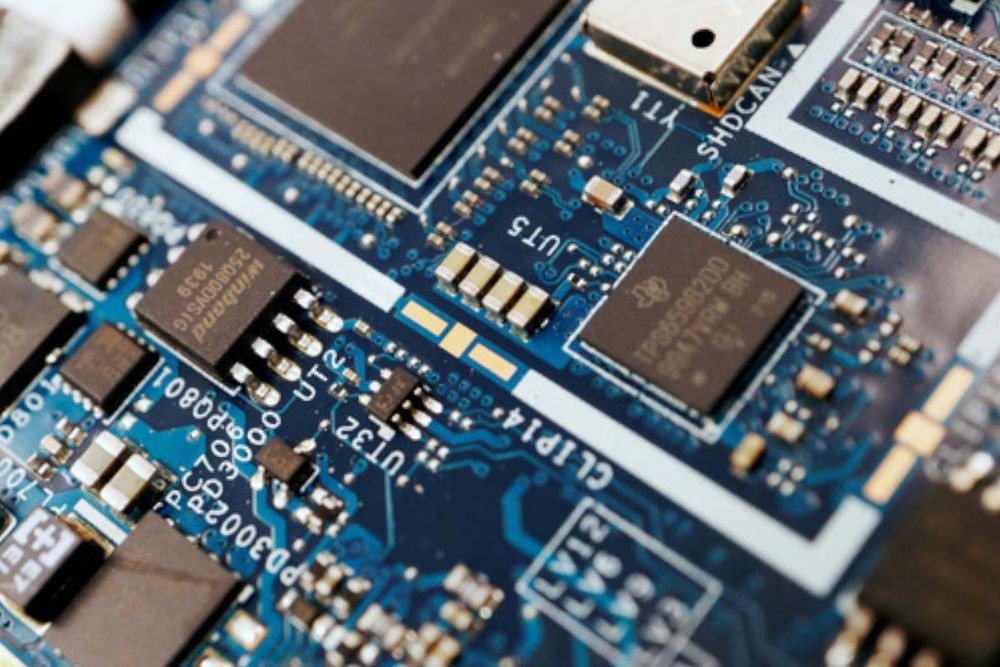

In March, Bloomberg reported that China plans to establish a fund worth $29.7 billion to support its domestic semiconductor industry. Experts interpret this move as China’s intention to overcome the impact of U.S. regulations on Chinese semiconductors by utilizing substantial funds and striving for a rebound in the situation.

It is predicted that this fund will receive investments of billions of yuan from various sources, including local governments such as Shanghai, Qingtong Holdings Group, and the National Development and Investment Corporation of China. Analysis suggests that immediate fundraising might be challenging and could take several months. It is also known that once the fund’s operations are finalized, China plans to support local semiconductor companies financially.

Bloomberg stated, “China is once again making efforts to actively leverage its domestic semiconductor market by establishing a large-scale fund.” It’s worth noting that the Chinese government had established semiconductor funds of $20.9 billion in 2014 and $30.1 billion in 2019.

At that time, companies such as SMIC and YMTC, foundries, and NAND flash manufacturers received subsidies. For example, the semiconductors installed in Huawei’s Mate 60 Pro smartphone launched in 2023 were produced by SMIC using Huawei’s advanced 7-nanometer microfabrication process under subcontract. Subsidized companies demonstrated enhanced technological capabilities following the subsidies. Additionally, CXMT, a promising Chinese DRAM company, received over $1.5 billion in financial assistance from the fund at the end of last year (2023).

Bloomberg analyzed, “While the U.S. regulates access to Chinese semiconductors not only in South Korea but also in most allied countries, new movements are occurring in China to establish a foundation for semiconductor self-sufficiency.”

While the Chinese semiconductor fund appears to be thriving, the market for individual investors paints a bleak picture for the future. According to an investment expert, the recent decline in China’s economic growth, coupled with assessments indicating that the economy has bottomed out, has led to a situation where large funds that previously poured into Chinese funds for profit through bottom fishing are now withdrawing as investor buying interest diminishes. He explained that the outflow of investment funds is due to the persisting slump in real estate investment, which is a crucial economic indicator for China, along with prevailing pessimistic economic outlooks.

According to fund evaluation agency F&Guide on April 1st, the total assets of 186 Chinese funds, which had been steadily increasing since the beginning of the year, have been analyzed to steadily decline after reaching a peak in early March.

In reality, the total assets, which were $5.8 billion at the end of January, increased to $5.9 billion by the end of February, surpassing $85 million in just one month. One month later, on March 8, it reached $5.9 billion, fueling expectations to climb to $5.9 billion. However, the sentiment shifted thereafter, showing a downward trend. By the end of March, after passing through $5.9 billion on the 15th of the same month, it decreased again to $5.8 billion, shrinking by $85 million once more.

The financial sector also witnesses capital outflows. It has been reported that during March, the KB China Mainland A-Share Securities Investment Trust decreased by 3.5 billion won, while the Shinhan China Dream Securities Investment Trust experienced a decrease of 3.4 billion won over the same period, indicating a decline in individual fund assets.

Furthermore, an economic expert elaborated that the overall net assets of Chinese funds are following a downward trajectory. The net assets of Chinese funds, which stood at 5.3391 trillion won at the end of last year (2023), experienced a significant drop to 5.1304 trillion won at the end of January this year, largely due to fluctuations in the Chinese stock market.

Despite seemingly recovering to 5.6126 trillion won as of March 15th due to robust stock price support policies by the Chinese government during the crisis, as of the end of last month, it had regressed back to 5.4167 trillion won, resembling the fund size at the beginning of the year.

Continuing its persistent downward trend since the beginning of this year, the Chinese fund’s performance recorded a brief positive turnaround with a yield of 2.11% in mid-last month. However, it reverted to a negative figure of -1.03% at the end of last month, re-entering the loss zone.

Recently, the Chinese government has been actively pouring efforts into improving the real estate industry and market by providing indiscriminate financial support to real estate developers and announcing plans to invest at least 1 trillion yuan (approximately 186 trillion won) in three major initiatives: providing affordable rental housing, renovating immigrant residential areas, and constructing infrastructure for dual-use (regular and emergency) purposes. However, analysts observe that despite the supply plans put forward by the Chinese authorities, corresponding demand has yet to show signs of recovery.

Kim Si Cheong, a Korea Investment & Securities researcher, commented, “Despite the current reduction in the five-year loan prime rate (LPR) and the relaxation of housing transaction regulations in China, there are no signs of improvement in housing demand.” He further explained, “The persistent slump in sales of newly constructed houses is a problem that is difficult to resolve in the short term and will likely burden the cash flow of related real estate developers in the medium to long term.”

Experts predict that if China’s real estate issues remain unresolved, Chinese funds will also experience a long-term decline.

Most Commented